Is Beijing Signaling An Imminent Currency Devaluation: China Unleashes Gold Buying Spree

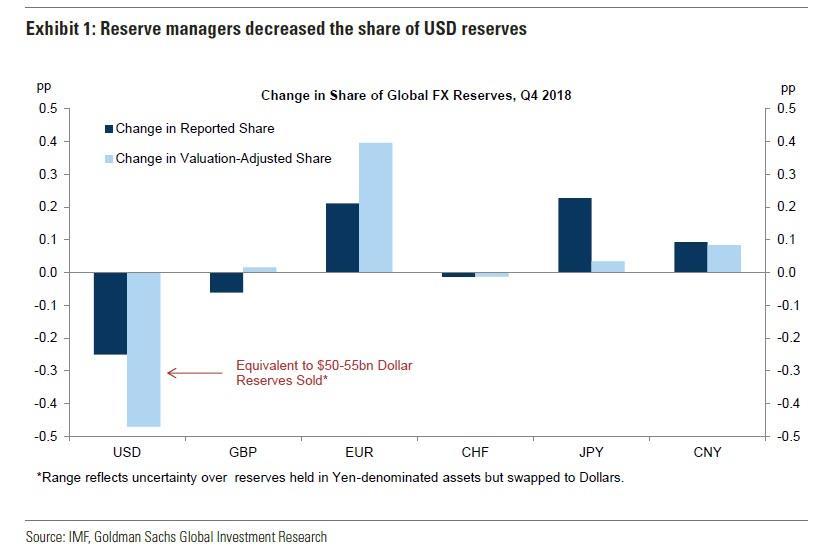

Last week we showed how, in a time when reserve managers are actively selling a modest if notable amount of their dollar reserve holdings and replacing them with everything from the yen, to the euro and yen, the one country that has decided it will no longer be part of the USD monetary sphere of influence, is Russia, which has been dumping dollars and buying gold at the fastest pace in decades.

Yet while Moscow's appetite for gold, which has doubled Russia's international gold reserves over the past three years, remains unparalleled, Beijing has also quietly joined its northern neighbor in casting a smaller if just as material vote of no confidence in the dollar: overnight, the PBOC reported that the world’s second-largest economy added to its gold reserves for the fourth straight month, adding to recent speculation that central banks globally will continue to build holdings even as they dispose of their US dollar reserves.

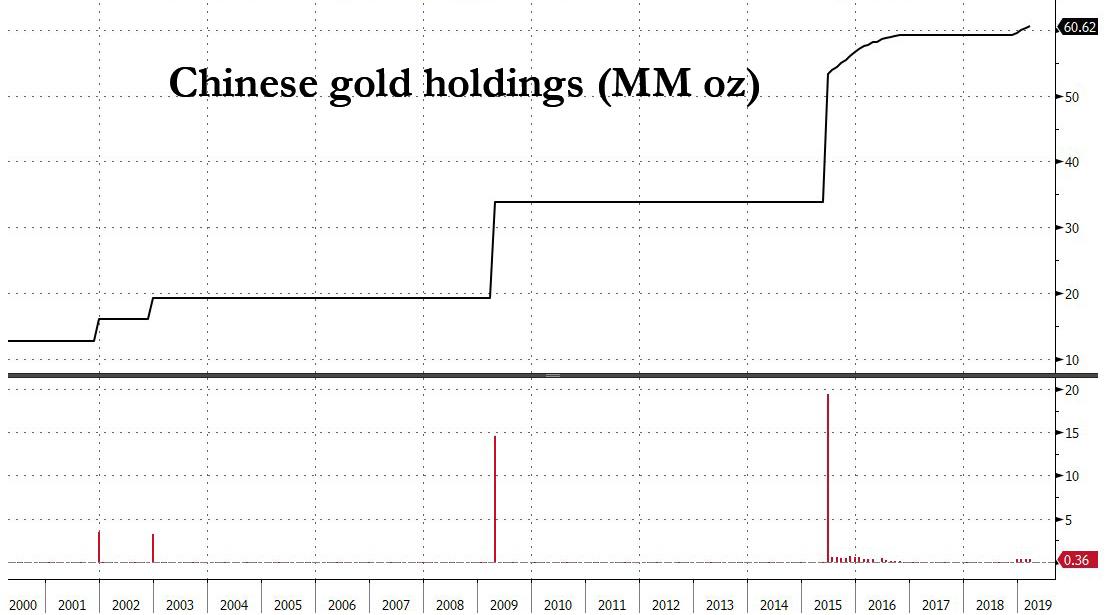

According to the latest Chinese reserve data, the country's gold reserves rose to 60.62 million ounces in March from 60.26 million a month earlier, according to data on its website. This was the fourth consecutive month of gold increases: last month’s inflow was 11.2 tons, following the addition of 9.95 tons in February, 11.8 tons in January and 9.95 tons in December. As shown in the chart below, the recent buying spree resumed after a 25 month hiatus, as China stopped reporting gold purchases in October 2016. This trend broke in December, when Beijing announced it had once again started accumulating gold.

As gold bugs are well aware, prior to the last accumulation episode, China had gone for long periods of time without revealing increases in its gold holdings, which confirms that for China reporting whether it is buying gold is not a matter of transparency but sending a clear, political signal (clearly one indicating declining faith in the dollar). When the central bank announced a 57 percent jump in reserves to 53.3 million ounces in mid-2015, it was the first update in six years. And as noted above, the latest pause was from October 2016 until December last year.

As Bloomberg notes, the latest PBOC data indicate that the country has resumed adding gold to its reserves at a steady pace, much like the period from mid-2015 to October 2016, when the country boosted holdings almost every month.

Two observations are worth making here: if China continues to accumulate physical gold at that pace over 2019, it will likely end the year as the top buyer after Russia, which added 274 tons in 2018. More important, however, is that the last time China resumed its gold purchases, was just three months before China's August 2015 yuan devaluation, which also unleashed a period of dramatic yuan volatility and Chinese economic weakness.

And since for China it is all about signaling - most analysts know that Beijing has been buying gold, it just hasn't been disclosing this - the question is what exactly is the recent resumption of China's gold buying meant to signal to the rest of the world?

Meanwhile, until we find out, the world's isn't sitting on its hands, as governments worldwide added a whopping 651.5 tons of bullion in 2018, the second-highest total on record, according to the World Gold Council, and nobody more so than Russia which quadrupled its reserves within the span of a decade amid President Vladimir Putin’s quest to break the country’s reliance on the U.S. dollar. Is China next?

https://www.zerohedge.com/news/2019-04-07/beijing-signaling-imminent-currency-devaluation-china-unleashes-gold-buying-spree

沒有留言:

發佈留言