CHINA HOLDS THE GOLD AND WILL MAKE THE RULES

April 25, 2019

Gold is the ultimate insurance against a bankrupt financial system, a corrupt political system and a rotten monetary system. But official propaganda, combined with people’s greed, mean that virtually nobody understands the necessity of insuring against these risks. Also, investors are convinced that stocks always go up and therefore that the 147x growth in the Dow since the end of WWII will continue unabated. Few understand that exponential growth in stocks is totally dependent on an equally exponential expansion of money printing and credit, including share buybacks.

But it isn’t enough to acquire insurance in the form of gold, it is also critical to insure the insurance. Most people who hold insurance in the form of cash, jewellery or gold, will hold it in a safe at home, in a bank safe or alternatively hide it.

DON’T HOLD VALUABLES AT HOME

All these methods are unsafe and therefore unsatisfactory. You should never hold more valuables at home than you are prepared to lose. Burglars today will not break into your house when you are away if they suspect you hold an important amount of valuables. Much easier to go to your house when you are home. Then they can threaten to kill your wife or children if you don’t tell them where your valuables are hidden. Many people believe they are clever by having two safes, one easily found with some minor items and money and then a well hidden one where most of the valuables are. Professional burglars are aware of this and will therefore threaten you until the second safe is revealed.

And even if you have a very safe hiding place, remember that most people can’t keep a secret. There was a survey in the UK Daily Mail a few years ago asking how long a woman could keep a secret…… The answer was 23 minutes! The survey did not include men but the result would probably have been similar. So please don’t keep any major valuables at home. Another problem is that most insurers wouldn’t insure major amounts of cash or valuables at home. And if they do, the premium would be very high.

BREAK-IN AT BANK IN BASEL – BANK NOT RESPONSIBLE FOR LOSSES

Many people believe that bank safe deposit boxes are safe. In our view this is not the case. Firstly there are regular break-ins. Last year, it happened to a major Swiss Bank, Raiffeisen in Basel. Burglars broke into the vault and opened 20 boxes without leaving a trace. Gold, coins, jewellery and cash were taken. The bank’s policy in these cases is very clear. They are not responsible for the contents of the box. Very often the contents is not declared for Swiss wealth tax purposes. Therefore, there is no inventory. Also, the contents is almost never insured. Insurance companies normally don’t insure the contents of a safe since it can’t be verified. The Bank would only pay out against a receipt of the content which nobody had. Bank Raiffeisen’s official line is: ”The insurance of the safe content is the responsibility of the customer. This is industry standard”.

So there we have it. If you keep valuables in a bank safe deposit box, it is at your own risk!

HATTON GARDEN ROBBERY

Also many private safe deposit companies have poor security. In 2015 there was a famous robbery at the Hatton Garden Safe Deposit Company in London. Hatton Garden is a well known jewellery district in central London. The elderly professional burglars managed to break into the building during a holiday weekend, disable the alarm and access the vault by abseiling down a lift shaft. Finally they drilled through the vault door. They emptied 60-70 boxes and may have taken as much as £35 million of valuables. They were later caught. A film called King of Thieves, starring Michael Caine was made of the robbery.

Also this time, most of the jewellery stolen was uninsured.

US GOVERNMENT ALSO BREAKS INTO SAFE DEPOSIT BOXES

But it isn’t just normal criminals breaking into safe deposit boxes. The US government is known for opening and confiscating contents of safe deposit boxes. All they need is a court order. And when the next banking crisis comes, the content of a bank safe deposit box could easily be part of a bail-in procedure.

I would not recommend to use bank safe deposit boxes in any country, not even in Switzerland. In principle, the valuables in a bank safe deposit box does not belong to the bank. But in bail-in situations, the rules might change. Also in case of a systemic collapse of the financial system or a longer bank holiday, bank customers might not get access to their box for a very long time, even several years.

KEEP PRECIOUS METALS IN PRIVATE VAULT WITH INSURANCE

Precious metals, like gold and silver, should be kept in the safest private vaults, in a safe jurisdiction like Switzerland or Singapore and outside the banking system. Insurance from a top insurer is critical. The insurance must also cover staff theft which is not always the case.

Remember that in a bank safe deposit box, there is no insurance and as explained above, the bank takes no responsibility for the stolen merchandise.

NO WESTERN CENTRAL BANKS ARE BUYING GOLD

There has been a lot of publicity about central banks having bought substantial amounts of gold in 2018, in total 651 tonnes which is the highest in 50 years. This is typical lazy reporters just picking up propaganda news releases. Journalism is no longer a skilled profession. There are no proper journalists who analyse events and draw intelligent conclusions. All they do is to read a press statement, copy it and print it in the news paper, or report it on television.

In relation to this gold story about central banks, it is not that they bought gold which is the real news. The important point is who bought the gold. Let’s see, did the USA buy, or the UK or Germany or any other major Western state. No of course not. The Central banks that bought gold are the ones which understand that the Western world’s political and financial system is on the verge of going under. This is why Russia bought 274t, Turkey 51t, Kazakhstan 50t, India 40t, Mongolia 22t and Iraq 7t. There were a couple of Eastern European countries which bought gold like Poland 26t and Hungary which increased its reserves ten-fold to 32t. Both Hungary and Poland are vociferous critics of the EU who clearly realise that the ECB and the Euro are unlikely to survive. But these two countries will certainly need to buy a lot more gold to protect against the risks they can see coming.

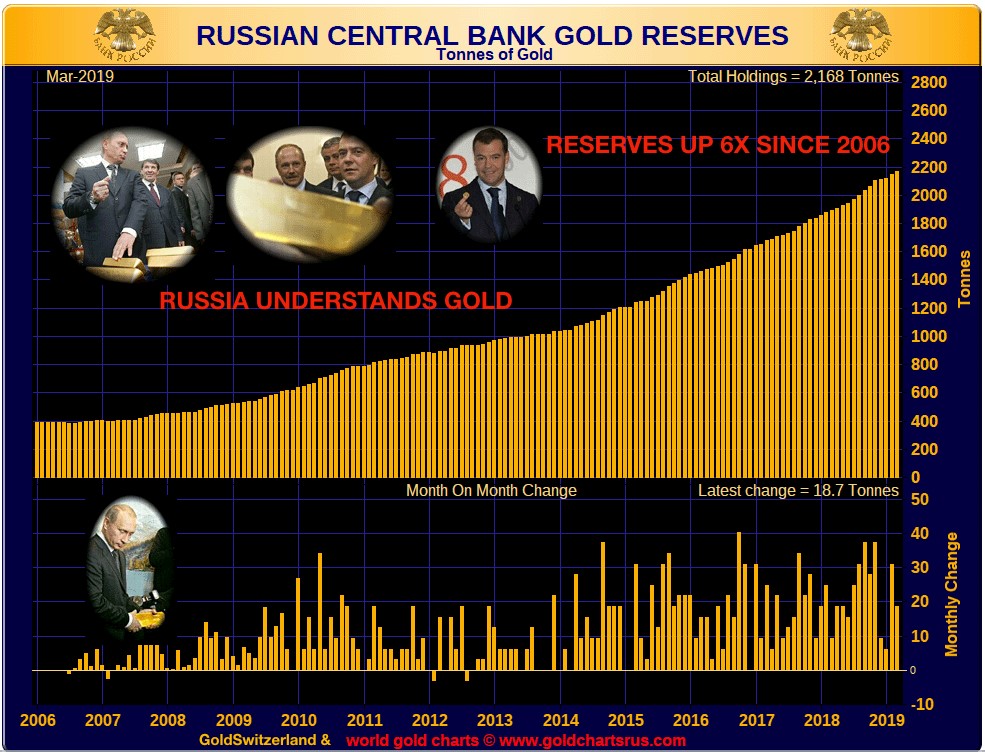

RUSSIA UNDERSTANDS GOLD

Russia understands that the Western financial system is bankrupt and is continuing to buy major amounts of gold at the same time that they have sold all their US treasury bonds. Since the beginning of the great Financial Crisis in 2006, Russia has bought almost 1,800 tonnes. This is officially more than any other Central Bank. (See China below)

Hungary stated as the reason for the 10x increase in gold reserves: “Gold’s role as a hedge against future structural changes in the international financial system, as well as its lack of counterparty risk.” Viktor Orban, the Hungarian Prime Minister, is one of the few statesmen who dares to openly criticise the EU and the Brussels Elite. He can clearly see the writing on the wall.

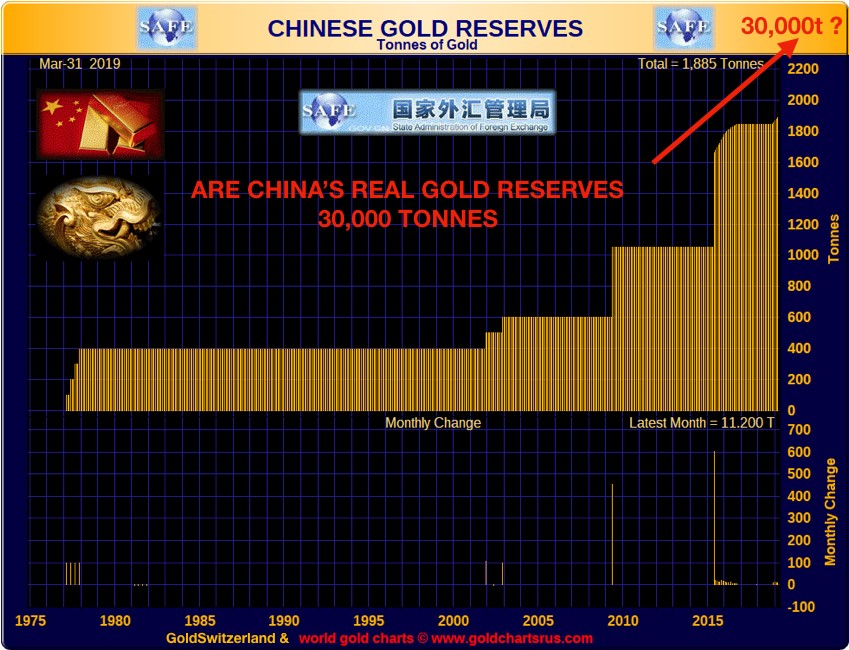

DOES CHINA HOLD 30,000 TONNES?

China announced a mere 10t increase in their gold reserves. China is frugal with news regarding their official gold reserves which are 1,852 tonnes. China is the world’s largest producer with 400t in 2018. None of the Chinese production leaves the country and it is probably safe to assume that the whole domestic production is absorbed by the state, although it is not in the official reserve figures. Together with major historical reserves that China has built up, their total gold holdings are probably in excess of 30,000 tonnes. Alasdair Macleod for example has estimated that China accumulated 25,000t between 1983 and 2002 and they probably had important reserves before 1983.

US OFFICIAL 8,100T GOLD IS PROBABLY GONE AND MOST OF IT IS IN CHINA

Compare that to the US which officially holds 8,100t. But most of that is probably either leased out or covertly sold. China has probably bought a major part of the US gold via the LBMA in London. So when China one day announces its real gold holdings of say in excess of 30,000t and possibly also backs the Renminbi with gold, the dollar will disappear into a black hole as the US will not be able to prove that they have anywhere near their declared 8,100t.

Remember the Golden Rule: Whoever holds the gold makes the rules!

https://goldswitzerland.com/china-holds-the-gold-and-will-make-the-rules/

沒有留言:

發佈留言